Via Axiomatic Gaming | News

M&A wrap: Bruce Stein, David Rubenstein, Michael Jordan, Axiomatic

October 26, 2018 | Author: Leo Hsu

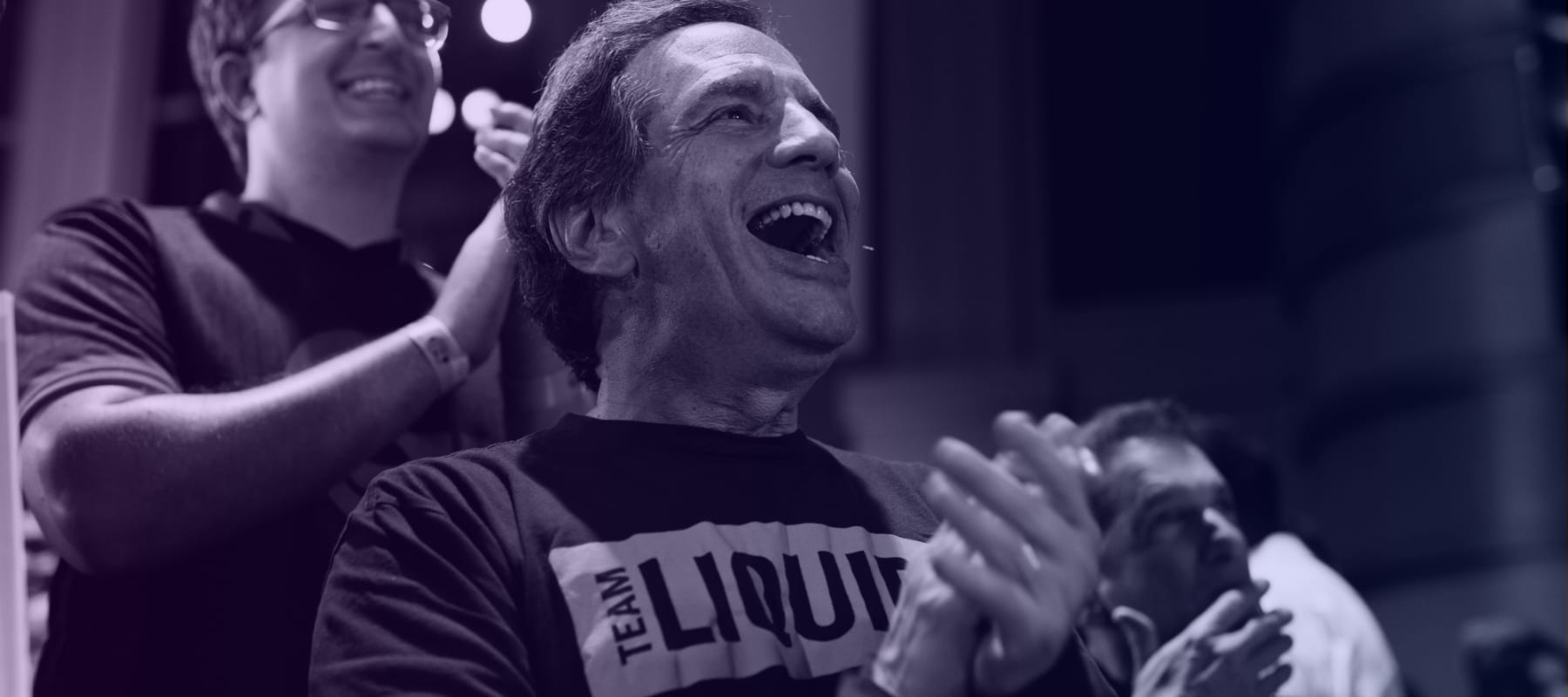

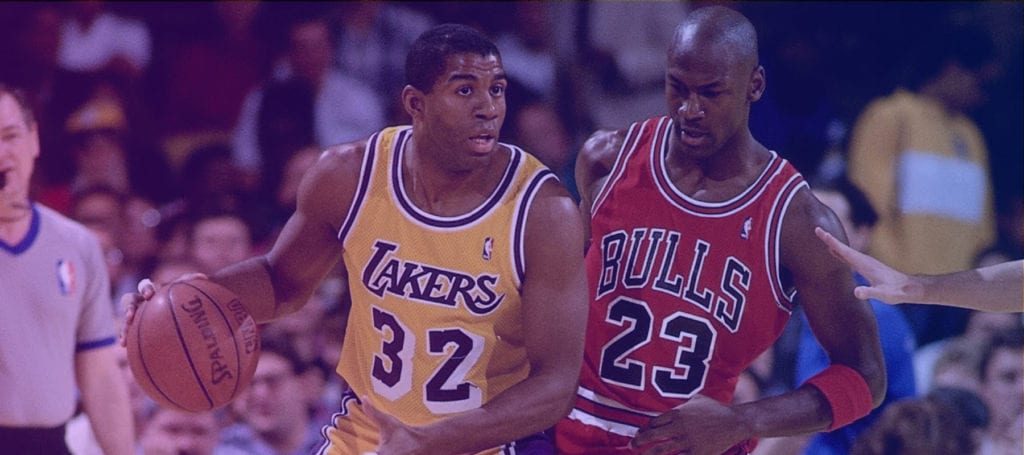

A group led by Michael Jordan and Carlyle Group LP (Nasdaq: CG) co-founder David Rubenstein have invested in e-sports and video game startup Axiomatic, which is led by CEO Bruce Stein (pictured). Rubenstein is investing through his family office Declaration Capital. Jordan, who owns the NBA’s Charlotte Bobcats, is remembered for winning six championships with the Chicago Bulls in the 1990’s. Axiomatic was started in 2015 to capitalize on the e-sports industry, which features professional video-game players competing for prize money in front of large audiences. In 2016, Axiomatic acquired a controlling stake in Team Liquid, another e-sports company. “The next generation of sports fans are e-sports fans,” says Axiomatic co-chairperson Ted Leonsis, who also owns the NBA’s Washington Wizards and the NHL’s Washington Capitals. “E-sports is the fastest-growing sector in sports and entertainment, and aXiomatic is at the forefront of that growth.” The e-sports industry is expected to generate about $906 million in revenue in 2018, according to research firm Newzoo. Also joining Jordan and Rubenstein on the investment are: Golden State Warriors and Los Angeles Dodgers part owner Peter Guber; Jeff Vanik, owner of the NHL’s Tampa Bay Lightning; and Oaktree Capital co-founder Bruce Karsh. Axiomatic is not Jordan’s first investment. He is also an investor in hiring startup Gigster; headphone maker Muzik; and sports data firm Sportradar. For more on athletes and their investments, see our list: Serena Williams and other athletes invest in healthy meals and more. Gibson Dunn & Crutcher advised Axiomatic.

Separately, a consortium that includes Axiomatic, Iconiq Capital, KKR & Co. (NYSE: KKR), Kleiner Perkins, Lightspeed Venture Capital, Smash Ventures and Vulcan Capital have invested about $1.25 billion in Epic Games, the maker of Fortnite. “Epic Games has fundamentally changed the model for interactive entertainment under the company’s visionary leadership,” says KKR director Ted Oberwager. Guggenheim Securities, the Raine Group and Smith Anderson advised Epic Games.